Returns Process: Is it still unpacked?

18 months ago, we conducted a survey in the UK called “Returns. Unpacked” to better understand:

- The situation of returns

- The pain points across the digital customer journey

- The impact of the pandemic and the appetite for alternative options

- The issue of the returns label

The output was the launch of our “Instant Returns” solution. Today, we want to provide an update on the status, and a broader view across other countries.

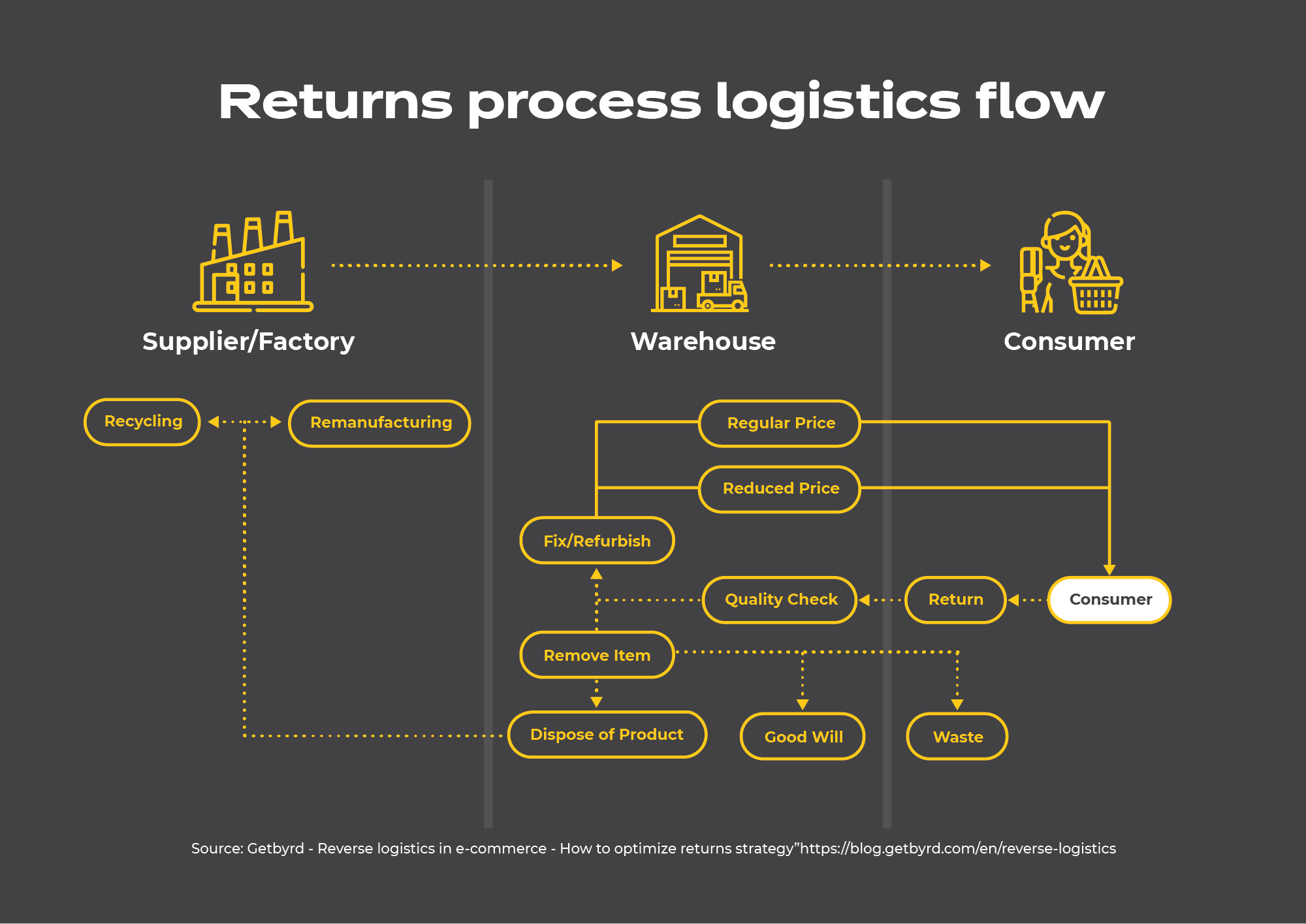

Returns process: A cross-functional flow

Obviously, due to the lockdowns during the pandemic, consumers have shifted habits and online retail has boomed: +52% in 2021 vs. 2019 according to a Statista report.

The same report predicts continued growth: +66% between 2021 and 2025, even despite macro-factors such as the war in Ukraine and the rising costs of energy, or change of behaviours such as returning in physical stores.

But what does it mean to manage end-to-end returns? What is the cost of returns? And who is owning the process?

Returns process: a complex set of challenges

Returning items is strongly linked with the second industrial revolution. This was the birth of mass-customisation and the emergence of new models, such as department stores.

With the extension of consumer protection, return policies became mandatory and managed under the European directive number 2011/83.

Often named as the “problem child” or “necessary evil” of retail, the return process covers a scope of different stages, involving many actors.

Returns: the total cost of the process

As we can see in the above image, every single item has to be opened, checked to see if there are any quality or labelling issues, and judged to define if it will be removed or resold (at full price or with a promotion). It is time and labour-intensive, and difficult to automate.

According to CBRE and Optoro, a reverse logistics expert, the total cost of a return is on average 66% of the price of a $50 item.

Returns process: a cross-functional impact

As previously mentioned, many departments are involved to manage the reverse logistics flow. In our study, we identified the top 3 impacted categories:

- Fashion or clothing

- Footwear

- Sportswear/activewear

We can group them under the “apparel” segment, for which McKinsey conducted a detailed analysis of the stakeholders involved.

One striking aspect is the fact that Marketing and E-commerce have little involvement in the process. During the pandemic, in order to ensure business continuity, their focus was on improving the digital customer experience.

Digital customer experience: An accelerator of returns

In 2011, Google introduced its Zero Moment Of Truth (ZMOT): it refers to the moment in the buying process when the consumer researches a product prior to purchase. The internet has changed how we decide what to buy and negative feedback on the returns process can damage the entire digital customer experience with consequences on brand perception and loyalty. So, why consumers are returning items? What are the main trends? And what is the current situation?

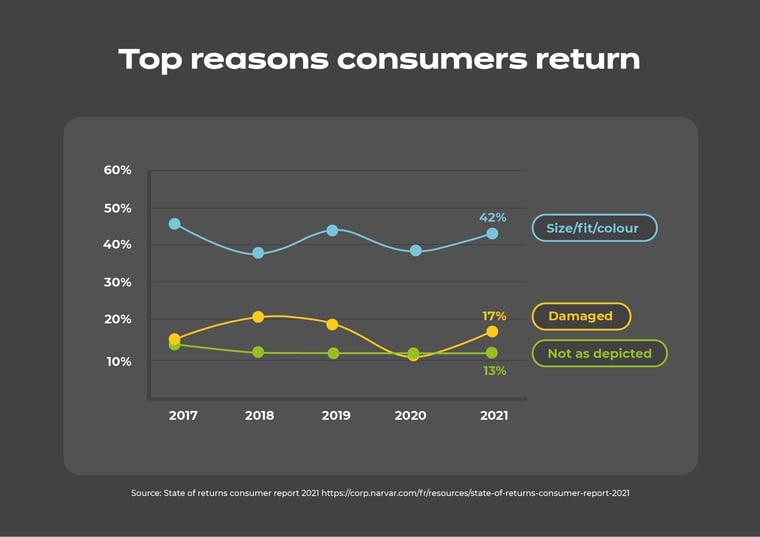

Why consumers return items?

Far beyond others, one item is returned because “it doesn’t fit”.

This trend is driven by Gen Z (16-24 year olds) and, according to a recent study, they buy on average three items at once and will return two in 82% of the cases. This behaviour is known as “bracketing”. And some of them even buy, wear once and return the item.

Knowing that three quarters of them buy online every month and that they represent 25% of the global population, the impact of their demands on returns policies is enormous!

Main changes in the digital customer experience

In our report, 49% of respondents said a returns process that isn’t free will put them off shopping with the same retailer again in the future. According to a more recent survey from Ivesp, it has now reached 79%.

It is now spreading across business sectors. Another recent study has shown for Auto-Parts it’s reaching 19.4%, almost the same level as fast fashion where returns can vary between 20 and 30%.

According to Barron’s, “Vehicles aged six to eleven years—in the aftermarket “sweet spot”—grew 9% in 2021 and are expected to increase 5% to 6% in the next two years.”

But is it also growing everywhere?

Returns process: Europe and US evolution

In our report, 1 in 3 items purchased online were sent back to retailers. According to Statista (see below), this percentage has increased to 49% in the UK, equivalent to a 1.5x rise in a one year.

![How common are online returns[1]](https://blog.inpost.co.uk/hs-fs/hubfs/Returns_Still_Unpacked/How%20common%20are%20online%20returns%5B1%5D.png?width=2000&height=1415&name=How%20common%20are%20online%20returns%5B1%5D.png)

In the US, the value of returns has risen from $428 billion in 2020 to $761 billion in 2021.

Clearly, efforts to make returns even easier have been nurturing this behaviour. But, as we mentioned in the beginning, returns have a cost.

Returns process: How to optimise it?

Some months ago, major retailers started to sound the alarm on the financial impact of returns. So, what is the status? What are the initiatives at play and how can we make the process more efficient?

Returns process: A major profitability concern for retailers

Reducing returns has been a focus of retailers in the past few years.

We can mention two initiatives:

In 2019, Nike launched an AR tool within its app that was able to measure users’ feet dimensions according to 13 criteria.

Lululemon” shows product details pages with different models according to height, size and shape.

However, it doesn’t seem that these initiatives were enough and the alternative was to activate a financial lever.

Last April in the UK, the most mature E-commerce country in Europe, leading retailers have been communicating on the devastating cost impact of returns, which was estimated to be £60 billion.

"ASOS has warned that its profits could drop from £190 million to £20 million this year as a result of the phenomenon”.

It was followed by the breaking news of Zara last June. According to Statista, “Inditex, headed by its flagship brand Zara, has decided to try to curb online returns, and it is not the only company that is starting to take steps towards this end. The Spanish textile giant has started to charge 1.95 euros to customers who want to return their order online. This measure is being applied in some thirty markets, including European markets such as the United Kingdom and Germany”.

In October this year, H&M announced a trial period of paid returns in the UK and Norway. Boohoo also introduced returns charges in the UK.

It seems that free shipping on returns is not a “must have” anymore and that there is a discrepancy between what customers want and what retailers make them do. However, are there non-monetary levers that can be pulled to improve reverse logistics?

Digital customer experience as enablers for logistics optimisation

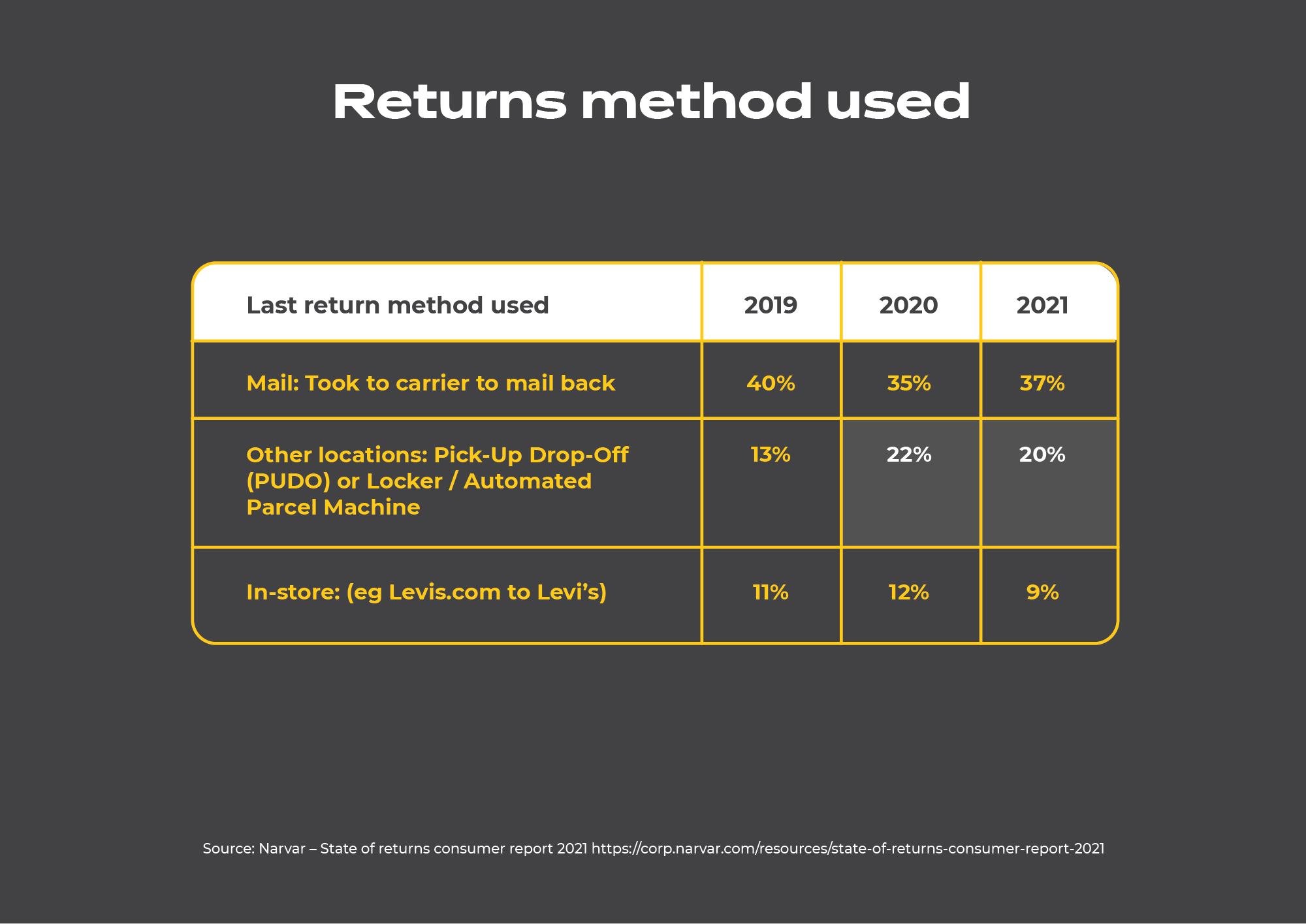

First enabler: guiding customers to return items via a retailer’s’ preferred channel. For example, it can save up to 18 days of processing time and improve the chances of reselling an item at full price versus significant markdowns when arriving at the end of the season.

How can we help? By emphasising convenience in dropping off the item. Adding options on their way to ‘work, shop or play’ is one facilitator.

Since 2019 the convenience of drop-off locations marches on in the US.

The last report from Last Mile Experts shows a similar percentage of drop-off usage as in the US, with a clear shift from to-door to lockers.

Let’s take a closer look at the second enabler to optimise return: labels.

Making the experience frictionless by removing the returns labels

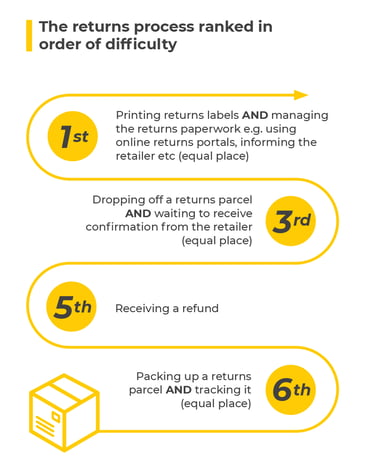

In our last report, 83% of shoppers said retailers should do more to make the returns process as easy and as fuss-free as possible.

Since 30% of online shoppers did not have access to a printer at home (rising to 44% of those aged 18-34), it was expected that 56% of people preferred not to print their own label at home, reaching 66% of those aged 18-34.

In order of difficulty, the returns process can be illustrated as follows:

As a result, the UK was the second country within InPost Group (after Poland) to launch ‘Instant Returns’ – a service that doesn’t require customers to print a returns label, either when at home, or at the point of dropping off. Instead, they are able to generate a QR-code, scan this it a locker, and store their parcel.

On 4th October 2022, InPost Italy has also followed suit. The launch is based on a reappropriation of the Spanish Netflix series “La Casa De Papel” (see below).

The Spanish series found huge success in France and Italy: From 3rd to 5th April 2020, it was more popular on a per capita basis in these two countries than in Spain.

What’s the story and the meaning? From season 1 onwards, a group of robbers have decided to hide themselves behind masks with the symbol of the Spanish artist, Salvador Dalí. Why him? Because Dalí was one of the artists of the Dada movement, rejecting modern capitalist society. In the series, besides wanting to get rich, the thieves actually plan to bring their cash back to the people.

This resonates with Gen Z and Millennials who are highly concerned by the cost of living and financial capabilities.

Moreover, it is also embedded in their lifestyles and their wish for a fully digital customer experience, especially for Gen Z, the first generation born with technology and its evolution and who are spending on average 8 hours per day on screens.

Together with our 24/7/365 locker network, we provide a quick and ultra-convenient shipping experience. For one key partner, our most recent customer insight shows that almost 60% of our customers drop their parcel within a 24-hour timeframe after requesting their return vs. 3.64 days on average.

Look at the video in the following link to see how easy it is!

This service illustrates our mission: “we simplify everything” by providing value to all stakeholders amongst the supply chain.

Find out more about integrating our Instant Returns service as one of your options here.